franklin county ohio tax deed sales

Certain types of Tax Records are available to the. 301 North Main St Suite 203 Lima OH 45801.

Sri Incorporated The Tax Sale Experts 317 842 5818

Our office hours are Monday Friday 800-430.

. John Smith Street Address Ex. Franklin County Auditor 373 S. 614-525-3438 FAX.

Ohio property tax sales are tax deed auctions or tax lien auctions. All eligible tax lien certificates are bundled together and sold as part of a single portfolio. The Franklin County Sales Tax is collected by the merchant on all qualifying sales made within.

They are a valuable tool for the real estate industry offering both buyers. The Delinquent Tax Division holds an annual tax lien sale to collect outstanding delinquent taxes. Successful bidders at the Warren County Ohio tax deed sale receive an Ohio tax deed.

You own the right to collect the past due taxes plus interest. Franklin County Treasurer 373 S. Third party purchasers may also obtain delinquent tax information in our office during normal business hours.

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Ohio is unique in that it offers both tax lien certificates and tax deeds. Responses to questions posed to the Clerk o f Courts office will be limited to the type of paperwork filed.

Look for lien certificate auctions in Franklin County Columbus Cuyahoga County Cleveland and Hamilton County Cincinnati. The Franklin County Treasurer holds the states first and best lien against real property located in Franklin County. The County assumes no responsibility for errors in the information and does not guarantee that the.

If you should have any further questions please contact our office at 509 545-3518 or email us at treasurercofranklinwaus. Generally the minimum bid at an Franklin County Tax Deeds sale is the amount of back taxes owed plus interest as well as any and all costs associated with selling the property. M-F 8AM-4PM Contact Us.

18 per annum for tax lien certificates. In the First Floor Press RoomAuditorium of the Franklin County Courthouse 373 S. 1 franklin county 1291981 2 cuyahoga county 1248514 3 hamilton county 813822 4 summit county 541228 5 montgomery county 531542 6 lucas county 430887 7 butler county 380604 8 stark county 372542.

DELINQUENT TAX DEPARTMENT UPDATE. Tax Deed Sale Sec. Properties are advertised for three consecutive weeks beginning five weeks prior to.

Tax Lien Sale Find out about our annual tax lien sale and access information for taxpayers and potential buyers. Franklin County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Franklin County Ohio. If the property is not.

8252021 - Vaccine Requirement For Employees. Questions pertaining to the annual sale process should be directed to Jeff Hancock at 502-875-8702. High St 21st Floor Columbus OH 43215 6145254663.

The following is a list of the services and duties of the Delinquent Tax Division at the Franklin County Treasurers Office. Once again the Franklin County Recorders Office had a record-breaking year that mirrored the fervor of the Central Ohio housing market. Sheriff Sales are not held on Federal Holidays.

Office Closed in Observance of Memorial Day. Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange for payment of the entire delinquency. High Street Columbus Ohio 43215 or online at http sfranklinsheriffsaleauctionohiogov.

They can then fill out an application for re-sale of tax title property on particular parcels - Land Sale Application for the commissioners to authorize the re-sale of the tax title property. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible. Overview of the Sale.

Click to read more. The sale vests in the purchaser all right title and. According to state law the sale of Ohio Tax Deeds are final and the winning bidder is conveyed.

If your Ohio property taxes are overdue the county treasurer can start a foreclosure against you in court Oh. For tax lien certificates investors can get yields as high as 18 per annum with a one year right of redemption. Interest Rate andor Penalty Rate.

Bankruptcy Learn how our office handles bankruptcy cases. FraudSleuth is a tool to help detect possible fraudulent activity on your name that can affect your property by automatically searching documents filed at the Franklin County Recorders Office. Get information on a Franklin County property and view your tax bill.

In 2021 our office recorded 234197 documents shattering our previous record set in 2020 of 209193. After a lien is sold if all lien charges and interest are not fully paid after one year the tax lien holder has the right to foreclose on the property. If you require further assistance please contact one of the following Franklin County government offices.

Search for Allen County Sheriffs real estate sales listings by address case number defendant name or sale date or browse all property listings. Search for a Property Search by. In an effort to recover lost tax revenue tax delinquent property located in Franklin Ohio is sold at the Warren County tax sale.

Franklin County Ohio Tax Deed Sales. Our Sheriff Sales are held every Friday morning at 900 am. Premium bid highest bid tax deeds.

The Franklin County Recorder stops accepting. They are the keeper of records and have the entire case file for each foreclosure case. These records can include Franklin County property tax assessments and assessment challenges appraisals and income taxes.

Both sales give you the chance to make big profits but the lien means you dont immediately own the property. They are maintained by various government offices in Franklin County Ohio State and at the Federal level. The Franklin County Ohio sales tax is 750 consisting of 575 Ohio state sales tax and 175 Franklin County local sales taxesThe local sales tax consists of a 125 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc.

123 Main Parcel ID Ex. 572119 and Tax Lien Certificates see notes Sec. Tax deeds are sold to the bidder with the highest bid.

In Ohio the County Tax Collector will sell Tax Deeds to winning bidders at the Franklin County Tax Deeds sale. The property is sold to the successful bidder state laws differ though often it is sold for the amount of unpaid taxes. HIGH ST 17TH FLOOR COLUMBUS OH 43215-6306.

572119 Finding - appraisal and saleThe court will enter a judgment and order the home sold at auction to satisfy the tax debt. Their phone number is 614 525-3621. 614-525-3438 FAX.

The Common Pleas Clerk of Courts Civil Division is located at 373 S. Email Us 614 525-3930 Facebook Twitter Instagram. High St 17th Floor Columbus OH 43215 6142218124.

Tax Deeds are sold to the bidder with the highest bid. Last week Franklin County Recorder.

Sri Incorporated The Tax Sale Experts 317 842 5818

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Ohio Foreclosures And Tax Lien Sales Search Directory

Tax Foreclosure Sales Katherine J Kelich Belmont County Treasurer

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Investing In Tax Liens In Ohio Joseph Joseph Hanna

Idaho Foreclosures And Tax Lien Sales Search Directory

Tax Sale Lists Richmond County Tax Commissioners Ga

Massachusetts Foreclosures And Tax Lien Sales Search Directory

Franklin County Treasurer Delinquent Taxes

The Essential List Of Tax Lien Certificate States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Sri Incorporated The Tax Sale Experts 317 842 5818

Franklin County Treasurer Delinquent Taxes

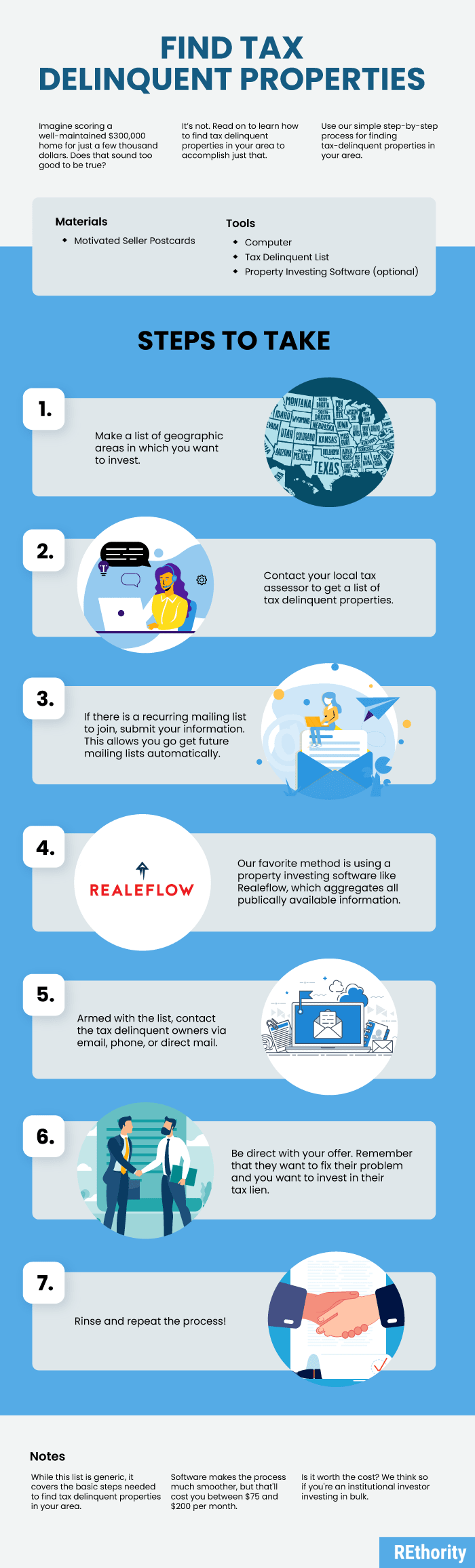

How To Find Tax Delinquent Properties In Your Area Rethority

Maine Foreclosures And Tax Lien Sales Search Directory

How To Find Tax Delinquent Properties In Your Area Rethority

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas